Contents

On a nice day 2 years ago, when I was in the financial field. My boss sent our team an email. In this email, he would like to us propose some machine learning techniques to predict stock price.

So, after accepting the assignment from my manager, our team begin to research and apply some approaches for prediction. When we talk about Machine Learning, we often think of supervised and unsupervised learning. But one of the algorithms we applied is one that we forgot however equally highly effective algorithm: Monte Carlo Simulation.

What is Monte Carlo simulation?

The Monte Carlo method is a technique that uses random numbers and probability to solve complex problems. The Monte Carlo simulation, or probability simulation, is a technique used to understand the impact of risk and uncertainty in financial sectors, project management, costs, and other forecasting machine learning models.[1]

Now let’s jump into python implementation to see how it applies,

Python Implementation

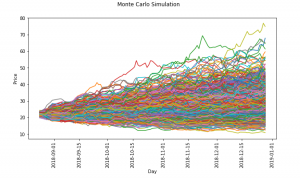

In this task, we used data of DXG stock dataset from 2017/01/01 to 2018/08/24 and we would like to know what is stock price after 10 days, 1 month, and 3 months, respectively

We will simulate the return of stock and next price will be calculated by

P(t) = P(0) * (1+return_simulate(t))

Calculate mean and standard deviation of stock returns

miu = np.mean(stock_returns, axis=0) dev = np.std(stock_returns)

Simulation process

simulation_df = pd.DataFrame() last_price = init_price for x in range(mc_rep): count = 0 daily_vol = dev price_series = [] price = last_price * (1 + np.random.normal(miu, daily_vol)) price_series.append(price) for y in range(train_days): if count == train_days-1: break price = price_series[count] * (1 + np.random.normal(miu, daily_vol)) price_series.append(price) count += 1 simulation_df[x] = price_series

Visualization Monte Carlo Simulation

fig = plt.figure() fig.suptitle('Monte Carlo Simulation') plt.plot(simulation_df) plt.axhline(y = last_price, color = 'r', linestyle = '-') plt.xlabel('Day') plt.ylabel('Price') plt.show()

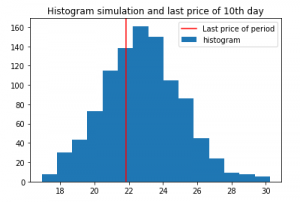

Now, let’s check with actual stock price after 10 days, 1 month and 3 months

plt.hist(simulation_df.iloc[9,:],bins=15,label ='histogram') plt.axvline(x = test_simulate.iloc[10], color = 'r', linestyle = '-',label ='Price at 10th') plt.legend() plt.title('Histogram simulation and last price of 10th day') plt.show()

We can see the most frequent occurrence price is pretty close to the actual price after 10th

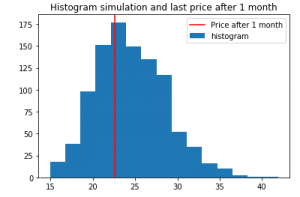

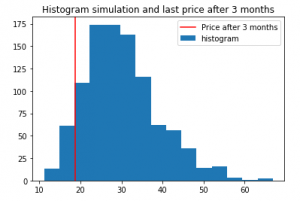

If the forecast period is longer, the results are not good gradually

Simulation for next 1 month

After 3 months

Conclusion

Monte Carlo simulation is used a lot in finance, although it has some weaknesses, hopefully through this article, you will have a new look at the simulation application for forecasting.

Reference

[1] Pratik Shukla, Roberto Iriondo, “Monte Carlo Simulation An In-depth Tutorial with Python”, medium, https://medium.com/towards-artificial-intelligence/monte-carlo-simulation-an-in-depth-tutorial-with-python-bcf6eb7856c8Please also check Gaussian Samples and N-gram language models,

Bayesian Statistics for more statistics knowledge.

Hiring Data Scientist / Engineer

We are looking for Data Scientist and Engineer.

Please check our Career Page.

Data Science Project

Please check about experiences for Data Science Project

Vietnam AI / Data Science Lab

Please also visit Vietnam AI Lab